Asset

An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. Assets are reported on a company’s balance sheet, and they are bought or created to increase the value of a firm or benefit the firm’s operations. An asset can be thought of as something that in the future can generate cash flow, reduce expenses, improve sales, regardless of whether it’s a company’s manufacturing equipment or a patent on a particular technology.

Fiat Currency

Fiat currency is declared by a government to be legal tender, but it is not backed by a physical commodity. The value of fiat currency is derived from the relationship between supply and demand rather than the value of the material that the currency is made of. Historically, most currencies were based on physical commodities such as gold or silver, but fiat is based solely on the faith and credit of the economy. Most modern paper currencies are fiat currencies; they have no intrinsic value and are used solely as a means of payment.

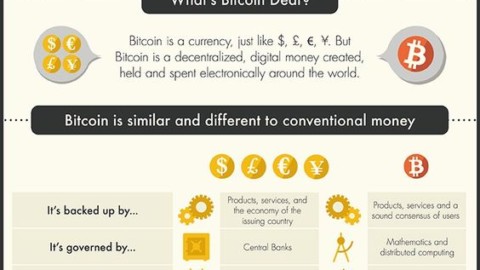

Difference between Fiat Currency and Cryptocurrency

Fiat currency is “legal tender” backed by a “central government.” It can take the form of physical dollars, or it can be represented by bank credit or bonds. The government controls the supply and you can pay your taxes with it.

Cryptocurrency is not “legal tender” and it is not backed by a central government or bank (it is decentralized and global). Its form is more like bank credit sans the bank (in that it is represented digitally, but not backed by a bank or government). An algorithm controls the supply and you can’t pay your taxes with it.

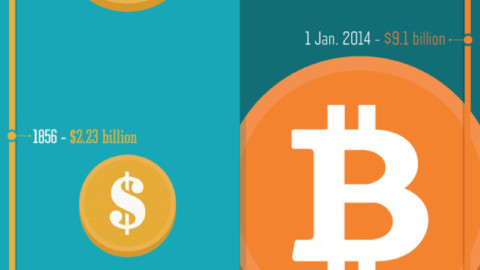

Market Capitalization

Also known as “market cap”, the term refers to the value of all outstanding shares of a company’s stock if you could buy them at the current stock price. In cryptocurrency investing, it refers to either price multiplied by the circulating supply (i.e. free float market cap) or price multiplied by the total supply (i.e. fully diluted market cap).

ICO Hard cap

The hard cap is the total issuance of a coin that will be created. This amount is fixed and specified before an ICO is launched. The coin distribution can never exceed this amount. A hard cap is often measured in USD.

ICO Soft cap

Generally refers to the minimum amount that an initial coin offering (ICO) needs to raise. If the ICO is unable to raise that amount, it may be cancelled and the collected funds returned to participants.

Risk-Return Spectrum

The risk–return spectrum (also called the risk-return ratio or risk–reward) is the relationship between the amount of return expected to be gained on an investment and the amount of risk undertaken in that investment. Often times, it is implied that the more return sought, the more risk must be undertaken.

Liquidity

Liquidity is the term used to describe how easy it is to convert assets such as cryptocurrency to cash. The most liquid asset, and what everything else is compared to, is cash. This is because it can always be used easily and immediately.

Another way of looking at it is how easily any asset can be bought or sold at a fair price.

Dividends

A portion of a company’s profits that is paid out to shareholders on a quarterly or annual basis.

Retail Investor

A retail investor is an individual who purchases assets (in this case cryptocurrency) for his or her own personal account rather than for an organization. Retail investors typically trade in much smaller amounts than institutional investors. Also known as an “individual investor” or “small investor”.

Investment Porftolio

An investment portfolio is a collection of assets owned by an individual or by an institution. It’s a pool of different investments by which an investor bets to make a profit (or income) while aiming to preserve the invested (principal) amount. These investments are chosen generally on the basis of different risk-reward combinations: from ‘low risk, low yield’ to ‘high risk, high yield’ ones; or different types of income streams: steady but fixed, or variable but with a potential for growth.

Cryptofolio

Cryptocurrency investment portfolio.